Ultimate Guide to Open a Prop Firm: Unlocking Success in the Financial Services Industry

Starting a proprietary trading firm, commonly known as a prop firm, is one of the most dynamic and lucrative pursuits within the Financial Services sector. It offers traders and entrepreneurs a unique platform to leverage capital, deploy sophisticated trading strategies, and generate significant profits. This comprehensive guide aims to walk you through every critical aspect of opening a prop firm, ensuring you possess the knowledge, strategic insights, and practical steps necessary to establish a successful enterprise in a competitive market.

Understanding the Concept of a Prop Firm in the Financial Industry

At its core, a prop firm is a financial enterprise that provides traders with capital to trade in various markets, such as stocks, forex, commodities, or cryptocurrencies. Unlike traditional investment firms, prop firms primarily generate revenue through trading profits rather than client commissions or assets under management. This business model offers an innovative pathway for experienced traders and ambitious entrepreneurs to transform their skills into a scalable business."

By opening a prop firm, entrepreneurs gain access to substantial trading capital, enabling them to amplify their trading portfolios significantly. This leveraged approach allows for more aggressive trading strategies, increased profit margins, and the opportunity to establish a powerful presence in the competitive financial landscape.

Key Benefits of Starting a Prop Firm

- Access to Capital: Enable traders to deploy larger positions without risking their personal funds.

- Profit Sharing: Revenue is often generated through profit splits with traders, leading to high earning potential.

- Market Flexibility: Diversify trading across multiple asset classes and markets for risk mitigation and opportunity maximization.

- Brand Authority: Establishing a reputable firm enhances credibility and attracts top-tier trading talent.

- Scalability: Grow your enterprise by onboarding more traders and expanding into new trading avenues.

Step-by-Step Guide on How to Open a Prop Firm

1. Conduct Market Research and Define Your Business Model

Successful prop firm owners rely heavily on strategic planning and market intelligence. Before your open a prop firm, analyze the current landscape, identify profitable niches, and understand your target audience. Decide whether your firm will focus on stocks, forex, futures, or a diversified approach. Clarify your unique selling proposition — will you offer proprietary trading algorithms, intensive trader development programs, or advanced risk management systems?

2. Develop a Robust Business Plan

A comprehensive business plan forms the backbone of your enterprise. It should outline your mission, vision, target market, funding sources, revenue model, operational plan, and growth strategies. Include detailed financial projections, emphasizing how you will generate revenue, manage expenses, and ensure profitability. A well-prepared plan not only guides your journey but attracts potential investors or funding partners.

3. Legal and Regulatory Compliance

Trading firms operate within a complex legal environment, with regulations varying by jurisdiction. It's crucial to consult legal professionals specializing in financial regulations to ensure your prop firm complies with relevant laws and licensing requirements. This may include registering with financial authorities, establishing proper corporate structures, and adhering to anti-money laundering (AML) and know-your-customer (KYC) standards.

4. Secure Funding and Capital

Capital is a critical aspect of opening a prop firm. You may need substantial initial funding to cover operational expenses, trading capital, technology infrastructure, and marketing. Options include personal savings, angel investors, venture capital, or strategic partnerships. Demonstrating a solid business plan and trading strategy can significantly enhance your chances of attracting investors.

5. Establish a Technologically Advanced Infrastructure

In the modern trading environment, technology is paramount. Invest in reliable trading platforms, high-speed internet, secure servers, and risk management software. Consider integrating proprietary trading algorithms or AI-driven analytics to give your firm a competitive edge. Your infrastructure should facilitate seamless trading, data analysis, and compliance monitoring.

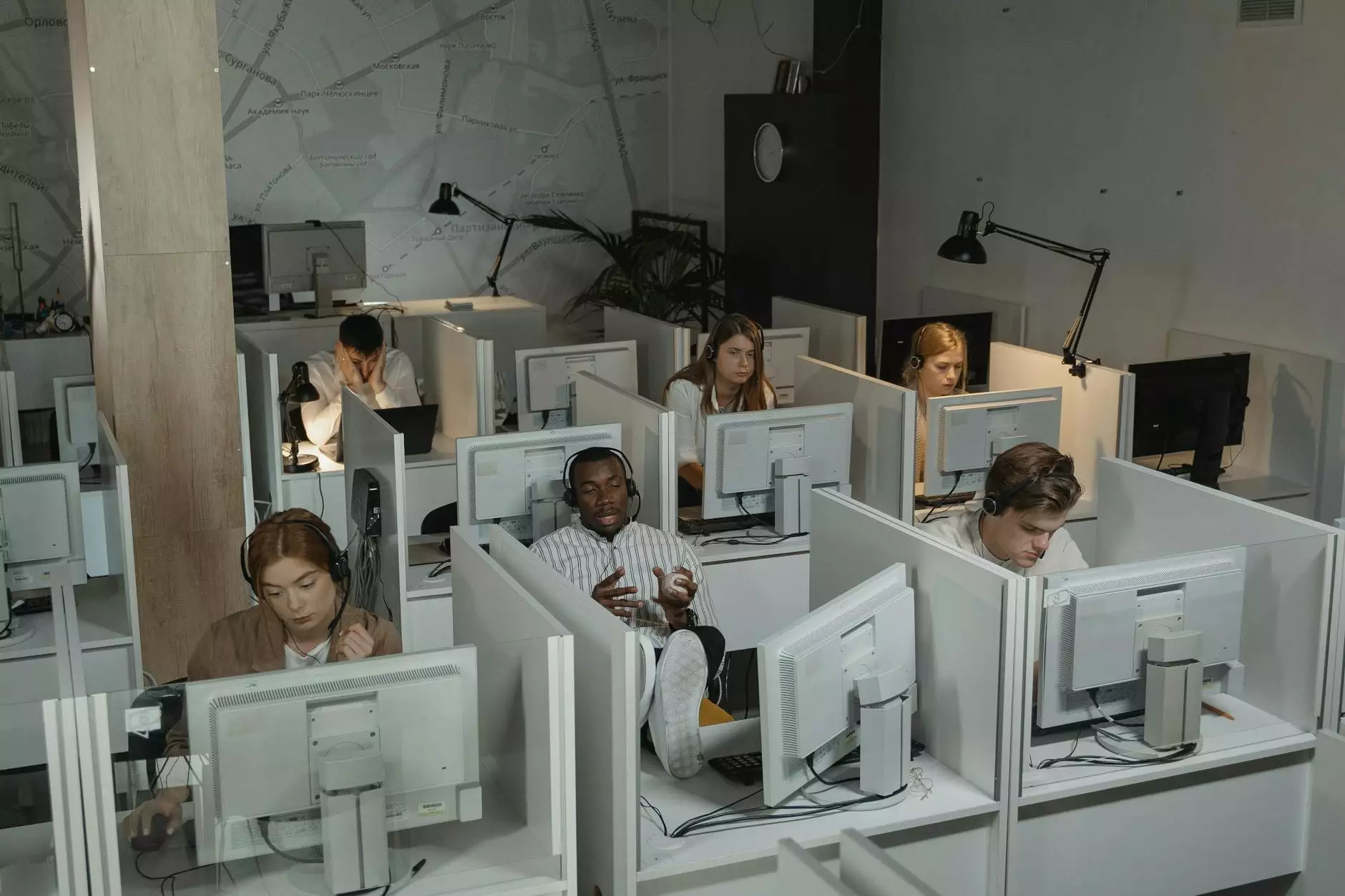

6. Recruit Skilled Traders and Support Staff

The talent component is pivotal to the success of your prop firm. Recruit experienced traders or those with high potential, emphasizing their skill, discipline, and risk management capabilities. Additionally, employ dedicated compliance officers, IT specialists, and administrative personnel to maintain operational integrity.

7. Develop Risk Management and Trading Policies

Effectiverisk management strategies are vital in preserving capital and ensuring long-term profitability. Define clear limits on leverage, position sizing, and loss thresholds. Implement strict trading guidelines and conduct periodic audits. Cultivate a culture of discipline and continuous learning within your trading team to foster sustainable growth.

8. Implement Marketing and Branding Strategies

To attract top traders and establish your reputation, develop a compelling branding strategy. Use digital marketing, social media, industry events, and partnerships to elevate your visibility. Highlight your firm’s strengths—be it innovative technology, excellent trader support, or transparent profit-sharing models—to differentiate your business.

Best Practices and Tips for a Successful Prop Firm Launch

- Focus on Transparency: Maintain clear communication about trading policies, profit splits, and risk management to build trust with your traders.

- Prioritize Technology: Continually upgrade your trading infrastructure to stay ahead in speed, security, and data analysis capabilities.

- Foster a Professional Culture: Encourage discipline, education, and accountability among traders to enhance overall performance.

- Monitor and Optimize: Regularly review trading activities and operational metrics to identify improvement areas.

- Expand Strategically: Start small, validate your model, then expand to new markets and increased trader capacity responsibly.

Challenges to Anticipate When Opening a Prop Firm

While the potential rewards are significant, launching a prop firm also entails challenges such as stringent regulatory requirements, market volatility, technological costs, and managing talented traders' expectations. Navigating these hurdles requires meticulous planning, strong leadership, and adaptability.

Future Outlook for Prop Firms in the Financial Sector

The financial industry continues to evolve with advancements in artificial intelligence, blockchain technology, and data analytics. These innovations create tremendous opportunities for prop firms to optimize trading strategies, reduce costs, and expand into new asset classes. As a result, the sector remains attractive for entrepreneurs aiming to make a substantial impact and earn substantial profits by opening a prop firm.

Conclusion: Take the Leap to Build Your Proprietary Trading Empire

Embarking on the journey to open a prop firm is both ambitious and rewarding. It demands a deep understanding of financial markets, strategic planning, technological investment, and operational discipline. With thorough preparation and a clear vision, you can establish a reputable firm that stands out in the competitive landscape and offers traders a platform to excel while generating sustainable profits for your enterprise.

Are you ready to turn your vision into reality? Harness your trading expertise, leverage cutting-edge technology, and prioritize compliance and risk management to build a successful prop firm that not only achieves financial gains but also fosters a vibrant community of skilled professionals driving innovation in the financial services industry.